Hawthorne Press Tribune

The Weekly Newspaper of Hawthorne

Herald Publications - El Segundo, Hawthorne, Lawndale & Inglewood Community Newspapers Since 1911 - (310) 322-1830 - Vol. 64, No. 4 - January 27, 2022

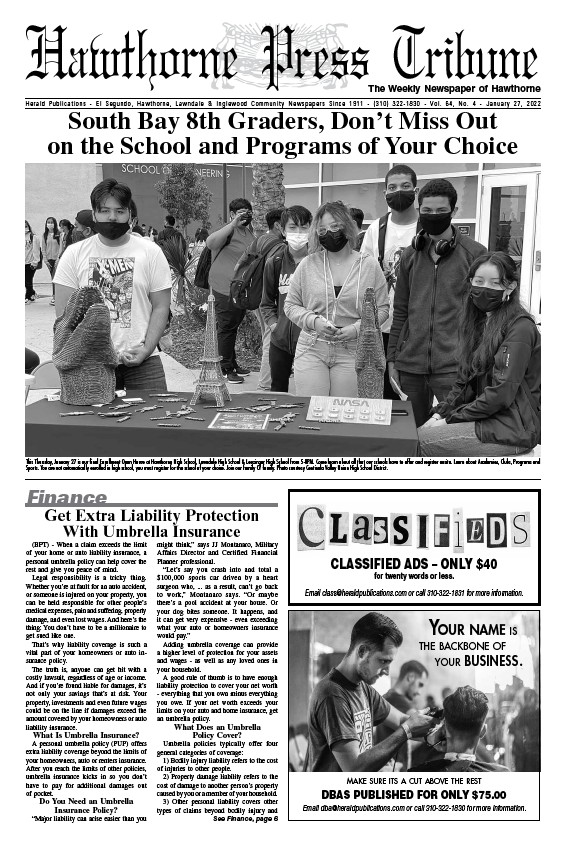

South Bay 8th Graders, Don’t Miss Out

on the School and Programs of Your Choice

This Thursday, January 27 is our final Enrollment Open House at Hawthorne High School, Lawndale High School & Leuzinger High School from 5-8PM. Come learn about all that our schools have to offer and register onsite. Learn about Academies, Clubs, Programs and

Sports. You are not automatically enrolled in high school, you must register for the school of your choice. Join our family CV family. Photo courtesy Centinela Valley Union High School District.

CLASSIFIED ADS – ONLY $40

for twenty words or less.

Email class@heraldpublications.com or call 310-322-1831 for more information.

Your name is

the backbone of

your business.

make sure its a cut above the rest

DBAS PUBLISHED FOR ONLY $75.00

Email dba@heraldpublications.com or call 310-322-1830 for more information.

Get Extra Liability Protection

With Umbrella Insurance

(BPT) - When a claim exceeds the limit

of your home or auto liability insurance, a

personal umbrella policy can help cover the

rest and give you peace of mind.

Legal responsibility is a tricky thing.

Whether you’re at fault for an auto accident,

or someone is injured on your property, you

can be held responsible for other people’s

medical expenses, pain and suffering, property

damage, and even lost wages. And here’s the

thing: You don’t have to be a millionaire to

get sued like one.

That’s why liability coverage is such a

vital part of your homeowners or auto insurance

policy.

The truth is, anyone can get hit with a

costly lawsuit, regardless of age or income.

And if you’re found liable for damages, it’s

not only your savings that’s at risk. Your

property, investments and even future wages

could be on the line if damages exceed the

amount covered by your homeowners or auto

liability insurance.

What Is Umbrella Insurance?

A personal umbrella policy (PUP) offers

extra liability coverage beyond the limits of

your homeowners, auto or renters insurance.

After you reach the limits of other policies,

umbrella insurance kicks in so you don’t

have to pay for additional damages out

of pocket.

Do You Need an Umbrella

Insurance Policy?

“Major liability can arise easier than you

might think,” says JJ Montanaro, Military

Affairs Director and Certified Financial

Planner professional.

“Let’s say you crash into and total a

$100,000 sports car driven by a heart

surgeon who, ... as a result, can’t go back

to work,” Montanaro says. “Or maybe

there’s a pool accident at your house. Or

your dog bites someone. It happens, and

it can get very expensive - even exceeding

what your auto or homeowners insurance

would pay.”

Adding umbrella coverage can provide

a higher level of protection for your assets

and wages - as well as any loved ones in

your household.

A good rule of thumb is to have enough

liability protection to cover your net worth

- everything that you own minus everything

you owe. If your net worth exceeds your

limits on your auto and home insurance, get

an umbrella policy.

What Does an Umbrella

Policy Cover?

Umbrella policies typically offer four

general categories of coverage:

1) Bodily injury liability refers to the cost

of injuries to other people.

2) Property damage liability refers to the

cost of damage to another person’s property

caused by you or a member of your household.

3) Other personal liability covers other

types of claims beyond bodily injury and

Finance

See Finance, page 6